How to make a Canadian mortgage tax deductible

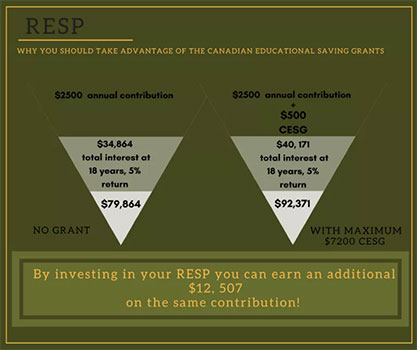

There are a lot of advantages to owning a principal residence in Canada. Property is an excellent hedge against inflation, it offers an opportunity to earn revenue from rentals (allowing the asset to act as an alternative to other fixed-income investment products) and any gain in value on your principal residence is sheltered from taxes […]

How to make a Canadian mortgage tax deductible Read More »